Have you been considering buying a new home but weren’t sure if it was the right time due to the current mortgage rates? You might be surprised!

As many may know, mortgage interest rates were recently expected to climb. Instead, interest rates have held fairly steady over the last few months and even fell slightly in February. In fact, as of February 27, 2019, borrowers were seeing an average interest rate as low as 4.14% for a 30-year fixed mortgage. In addition, the 15-year fixed mortgage rate was as low as 3.57% while a 5/1 ARM mortgage rate was averaging at 3.85%.

Zillow’s Economic Analyst, Matt Speakman, says, the latest mortgage interest rates were brought on by “a heavy dose of economic data releases, which are still playing catch-up from the partial U.S. government shutdown. The clearest signal may have been offered by Wednesday’s unexpectedly strong pending home sales release, a sign of improvement for the housing market, which has been a soft spot in the economy for the last several months. Looking ahead, all eyes are on Thursday’s initial Q4 GDP reading and Friday’s inflation data release, two key indicators Fed officials watch to evaluate the health of the U.S. economy.”

For more information about the latest mortgage interest rates, please visit Zillow.

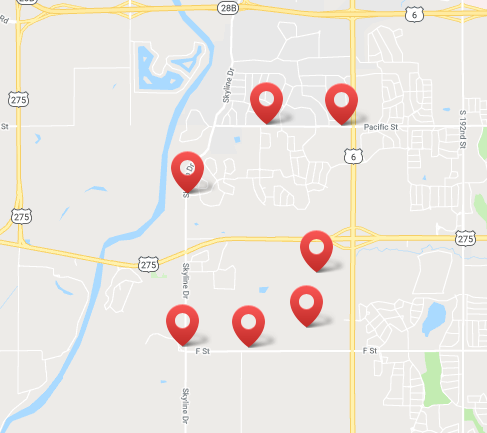

Now is the perfect time to take advantage of these low mortgage interest rates by purchasing a new home! Check out our available homes, or contact our team to learn more about the home building process.

Recent Comments